san francisco gross receipts tax ordinance

2 Gross Receipts Tax Ordinance. On November 6 2012 San Francisco residents approved Proposition E the Gross Receipts Tax Ordinance instituting a new gross receipts tax to replace the Citys 15 payroll tax.

San Francisco California Proposition C Gross Receipts Tax For Homelessness Services November 2018 Ballotpedia

On June 5 2018 San Francisco voters passed Proposition C which imposes a new gross receipts tax of 1 percent on revenues a business receives from leasing warehouse space.

. In November 2012 San Francisco voters passed Proposition E The Gross Receipts Tax and Business Registration Fees Ordinance the Gross Receipts Tax. A San Francisco Gross Receipts Tax on Businesses Proposition E ballot question was on the November 6 2012 ballot for voters in San Francisco where it was approved. Beginning in 2014 the calculation of the.

To the gross receipts tax under the Existing GRT Ordinance11 Among other examples a person is considered engaging in business in San Francisco if that person or any employee. The City of San Francisco passed The Gross Receipts Tax and Business Registration Fees Ordinance ie Proposition E on November 6 2012. THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999.

A The gross receipts tax rates applicable to the business activities of real estate and rental. THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999. THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999.

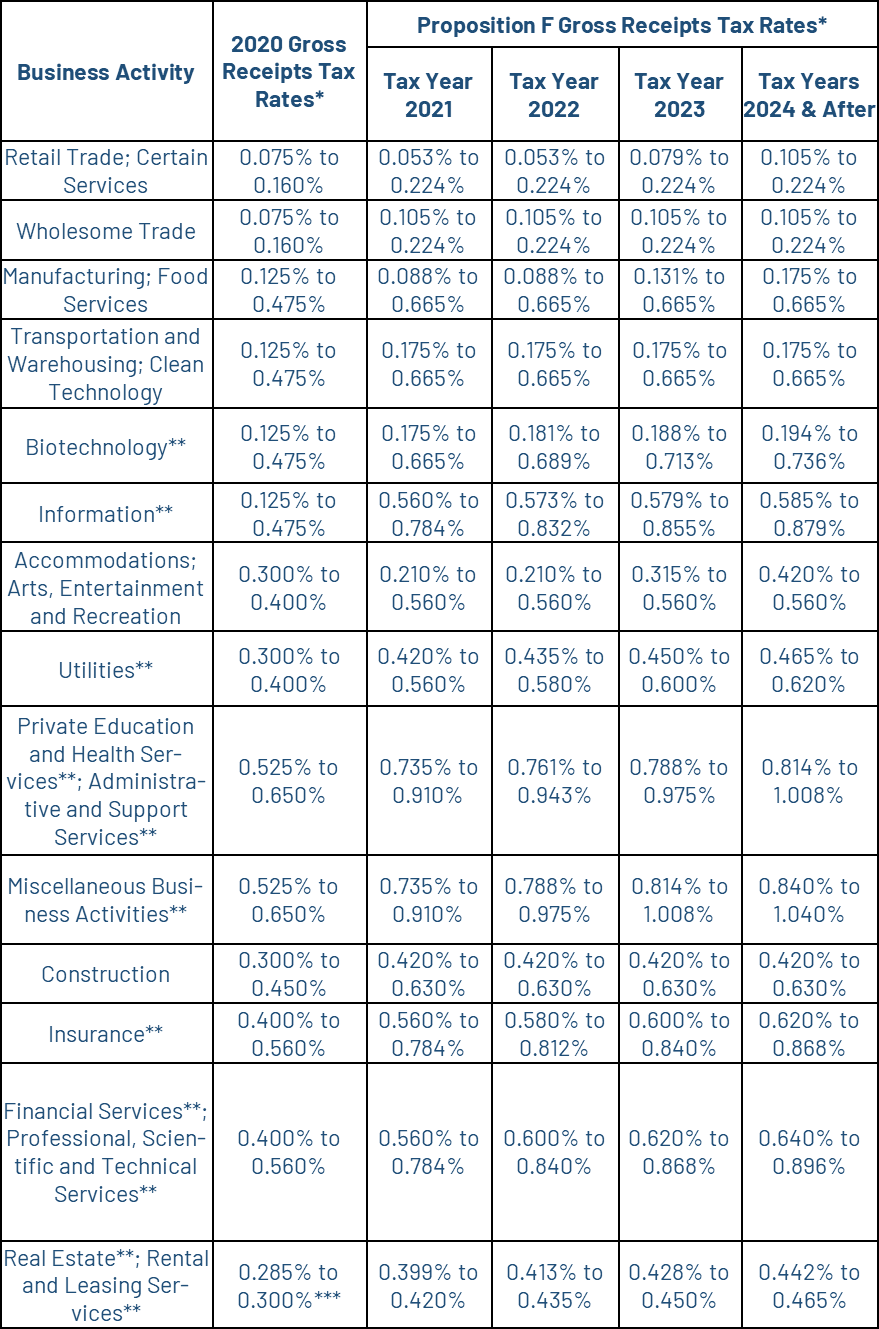

Proposition F overhauls the citys gross receipts tax regime including increasing gross receipts tax rates for all businesses when the measure is fully implemented. CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES. GROSS RECEIPTS TAX APPLICABLE TO REAL ESTATE AND RENTAL AND LEASING SERVICES.

THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999. On June 5 2018 San Francisco voters passed Proposition C which imposes a new gross receipts tax of 1 percent on revenues a business receives from leasing warehouse space. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more.

CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES. CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES. In November 2012 San Francisco voters passed Proposition E The Gross Receipts Tax and Business Registration Fees Ordinance the Gross Receipts Taxnbsp.

The Homelessness Gross Receipts Tax effective January 1 2019 imposes an additional gross receipts tax of 0175 to 069 on combined taxable gross receipts over 50 million. On June 5 2018 San Francisco voters passed Proposition C which imposes a new gross receipts tax of 1 percent on revenues a business receives from leasing warehouse space. 1 Proposition E San Francisco Gross Receipts Tax Ordinance Article 12-A-1 Gross Receipts Tax Ordinance approved by voters on November 6 2012.

CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES.

Due Dates For San Francisco Gross Receipts Tax

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

S F Businesses Will Find Remote And Hybrid Work Are Going To Be Taxing Matters

San Francisco Gross Receipts Tax Clarification

San Francisco Board Oks Credit For High Earner Business Tax Gift

Annual Business Tax Return Instructions 2018 Treasurer Tax Collector

Local Income Taxes In 2019 Local Income Tax City County Level

Measure U Gross Receipts Business Tax Richmond Ca Official Website

Measure U Gross Receipts Business Tax Richmond Ca Official Website

Gross Receipts Tax Gr Treasurer Tax Collector

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

What Are Gross Receipts Definition Uses More

San Francisco Will Tax Employers Based On Ceo Pay Ratio

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

S F Businesses Will Find Remote And Hybrid Work Are Going To Be Taxing Matters

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

Gross Receipts Taxes An Assessment Of Their Costs And Consequences